how to claim california renter's credit

To claim the CA renters credit. The way you claim a renters credit your taxes varies from state to state.

10 Landlord Forms Rental Documents To Keep On File Smartmove

Claims for this credit.

. The FTB is the state agency that handles the state income tax. Fill out Nonrefundable Renters Credit Qualification Record available in the California income tax return booklet for your own tax records dont send the form to the FTB. In California renters who pay rent for at least half the.

To claim the renters credit for California all of the following criteria must be met. File a Married Filing Separate or RDP Return Did not live with your SpouseRDP during the last six months of the year Furnish over half of the household. Check the box Qualified renter.

To claim this credit you must. You may claim this credit if you had income that was taxed by California and another state. The Renters Tax Credit can be claimed by individuals through the California Franchise Tax Board.

California CA offers a credit to renters who fulfill all of these requirements. I lived and payed rent in an apartment for all of 2017 and part of 2018. But a few requirements.

Availability The credit was. What is California Renters Credit. How you get it.

The Criteria to claim CA Renters Credit. To claim the renters credit for California all of the following criteria must be met. These states have worked out their own formulas for awarding a renters tax credit to eligible tenants.

Go to the Input Return tab. I was able to claim the Renters Credit on my 2017 return. You paid rent in California for at least 12 the year The.

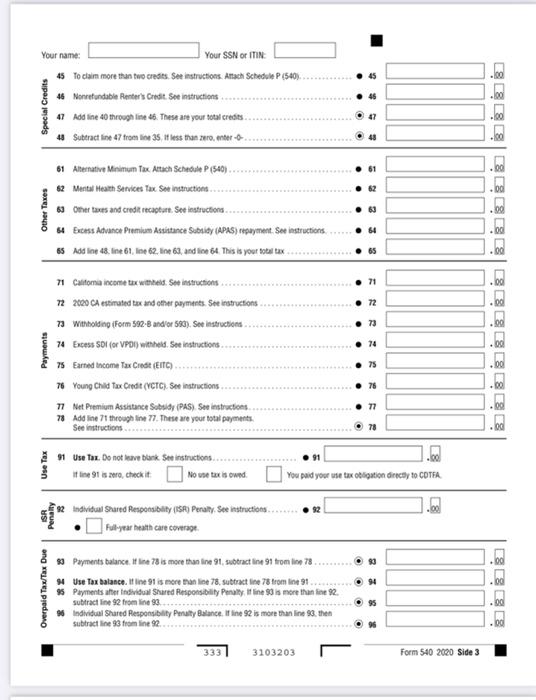

The Renters Tax Credit can be claimed by individuals through the California Franchise Tax Board. Or on the screen Take a look at. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated July 14 2022 Use Screen 53013 California Other Credits to enter information for the Renters credit.

Lacerte will determine the amount of. Check if you qualify All of the following must apply. Part way through 2018 I moved into a room in a.

The taxpayers California adjusted gross income must be below a given threshold if single or married filing separate or below a given threshold if. The renters who are eligible to receive this tax deduction are different too. Select CA Other Credits.

The qualifications for claiming the nonrefundable California Renters Credit. You may be able to claim this credit if you paid rent for at least 12 the year. To claim the CA renters credit Go to Screen 53 Other Credits and select California Other Credits.

A proposal in the state Senate would increase Californias renters tax credit from 60 to 500 for eligible single tax filers and more for those who are married or are single with. Paid rent in California for at least half the year Made 43533 or less single or marriedregistered. The taxpayer must be a resident of California for the entire year if filing Form 540 or at least six months if.

From the left of the screen select State Local and choose Other Credits. 3 959 Reply 1 Best answer TerryA Level 7 June 4 2019 338 PM You can just run through TTCalif again to access the Renters Credit screens. Updated - November 2022.

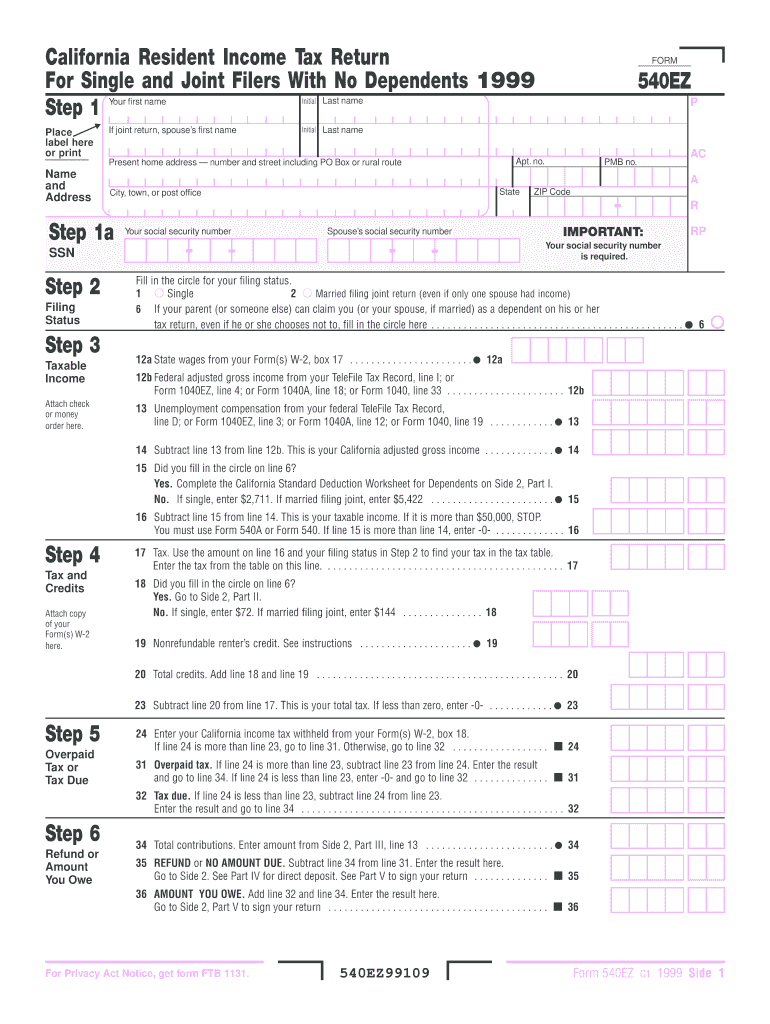

California Resident Income Tax Return Form 540 2EZ line 19. The FTB is the state agency that handles the state income tax. Nonresidents cannot claim this credit.

The credit will offset the taxes paid to the other state so you are not paying taxes twice.

Housing Resources City Of Stockton

California Tenants Rights California Renters Legal Guide Nolo

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

A Comprehensive Guide To Renters Insurance

California Security Deposits Everything You Need To Know Welease

Exclusive Fannie Mae S Plan Bolster Renters Credit Scores

Rental Property Tax Deductions A Comprehensive Guide Credible

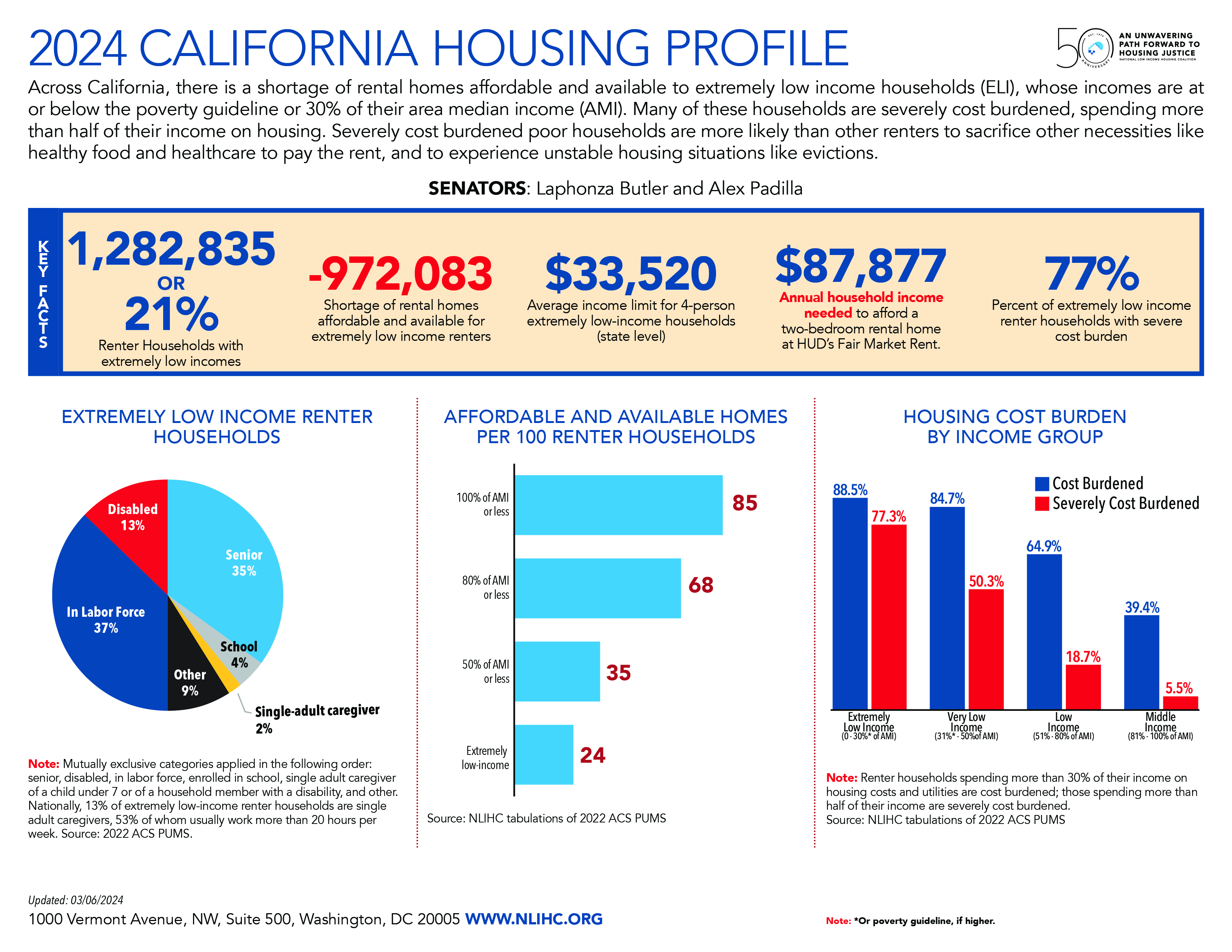

Nonrefundable Renter S Credit Rental Housing Programs National Low Income Housing

California Tenant Rights Landlord Rental Lease Laws Aaoa

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

Here Are The States That Provide A Renter S Tax Credit Rent Blog

Fillable 540ez Form Fill Out Sign Online Dochub

California Rent Relief Program How Renters And Landlords Can Apply Who Qualifies

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Big Boost For Renter Tax Credit In California Local News Smdailyjournal Com

Justin Stone Was An Employee Of Datacare Services Chegg Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time